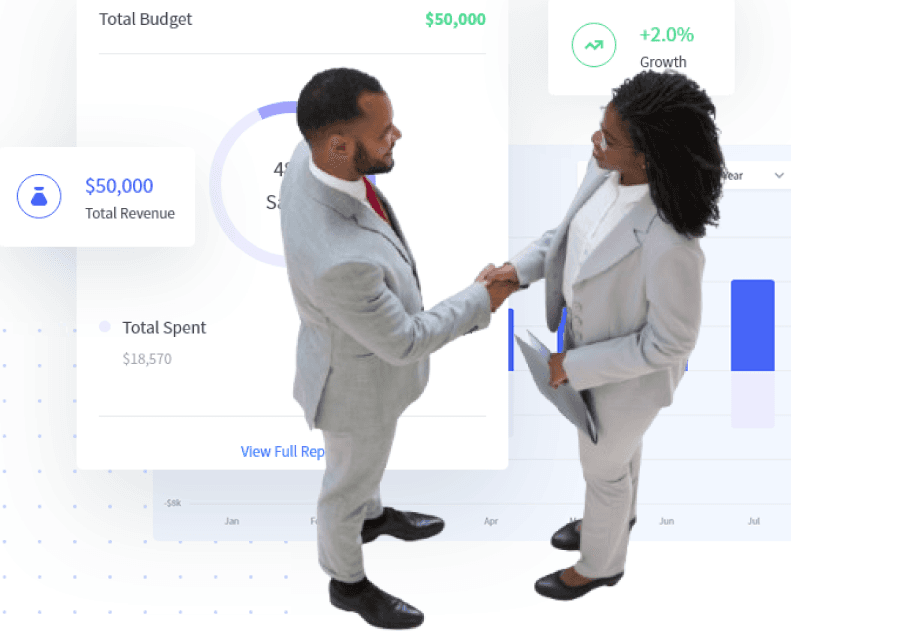

Fuel Your Growth with Africa's Capital Marketplace

Capital Connect is Africa's digital capital raising marketplace, where ambitious businesses meet aligned investors. Beyond matchmaking, we equip you with readiness tools, valuations, insights, and advisory support, everything you need to raise with confidence. Whether you are a startup or scaling enterprise, we help you secure the right capital, faster. Join 1,500+ ambitious businesses already using Capital Connect to secure funding.

%2520png.png&w=640&q=75&dpl=dpl_D3bbPpS3R8RAvMt3nmsPDbKty4Be)

.png&w=3840&q=75&dpl=dpl_D3bbPpS3R8RAvMt3nmsPDbKty4Be)